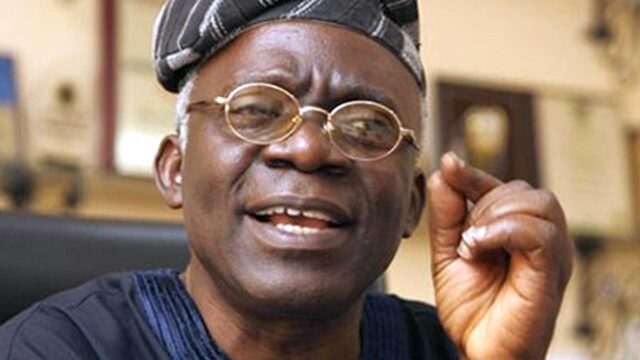

Human rights activist and Senior Advocate of Nigeria (SAN), Femi Falana, has taken legal action against the Central Bank of Nigeria (CBN) at the Federal High Court over its decision to float the naira, describing it as illegal.

This was made known by Falana when appeared as a guest on the Channels Television programme, Sunrise Daily, on Friday, August 18, 2023, where he stated that the CBN act made it compulsory for the apex bank to fix the exchange rate.

Falana, who insisted that there is no provision for floating the naira, noted the decision to allow the value of the naira to be determined by market forces is not backed by law.

CBN has a duty to fix the exchange rate

The human rights lawyer said, “There’s no provision for floating the naira. It’s illegal. You say, ‘The value of the naira will be determined by market forces.’ That is not there in the law,” he said.

- “I’ve had to sue the Central Bank of Nigeria at the Federal High Court because Section 16 of the Central Bank Act has imposed a duty on the Central Bank to fix and determine the rate of the naira vis-a-vis other currency.”

He noted that Section 20(1) of the CBN Act provides that the only legal tender in Nigeria shall be the currency notes issued by the Central Bank: “only the naira.”

Section 20 (5) of the Act also provides that anybody who spends any other currency in Nigeria without the approval of the central bank has committed an offence “and shall be prosecuted”, he explained, adding, “The penalty is six months’ imprisonment.”

Falana argued further that as long as government officials are not prepared to strengthen the naira and make it the only legal tender in Nigeria, “we’re not going to go far”.

FG’s N5 billion to states diversionary

While commenting on the Federal Government’s approval of N5 billion for each state and the Federal Capital Territory (FCT) to enable them to procure food items for distribution to the poor in their respective states, Falana argued that the measures were diversionary.

- He said, “They are temporary measures. Some of them are quite diversionary and the people in government have not addressed the root of the crisis, which is the dollarisation of the economy.

- “Whatever palliatives that are announced will be eaten up by the dollarisation of the economy.”

What you should know

On June 14, 2023, the CBN announced the unification of all segments of Nigeria’s foreign exchange market, consolidating all windows into one.

This action was part of a series of immediate changes aimed at improving liquidity and stability in the Nigerian Foreign Exchange (FX) Market.

Under this directive, commercial banks were given permission to remove the rate cap on the naira at the Investors and Exporters (I&E) window of the foreign exchange market, allowing for a free float of the naira against the dollar and other global currencies.

The CBN’s decision to float the currency and unify the country’s multiple exchange rates has been praised by the organized private sector, financial experts, and economists.

They believe this move will bring transparency and stability to the forex market, as well as attract more foreign investment and capital inflow into the economy.

However, some groups including organized labour criticized the policy which they said is not well thought out and has led to a spike in exchange rate with the attendant increase in the cost of goods and services.