The Central Bank of Nigeria (CBN) failed to publish details of the country’s external reserves amounting to $40.23 billion during the 2021 financial year, according to the latest report from the Office of the Auditor General of the Federation.

The 2021 report, released in December 2024, also revealed that the Central Bank of Nigeria (CBN), under the leadership of Godwin Emefiele, breached its internal policies on dollar time deposits.

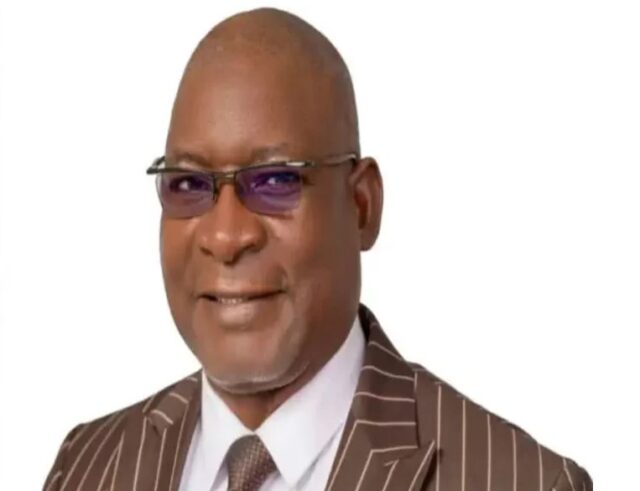

Mr Emefiele is facing prosecution by the Economic and Financial Crimes Commission (EFCC) at the High Court of the Federal Capital Territory, Abuja, for alleged fraudulent activities during his tenure as CBN governor, which ended in June 2023.

![Godwin Emefiele, the former governor of Central Bank of Nigeria (CBN). [Image sourced from CBN Twitter account]](https://i0.wp.com/media.premiumtimesng.com/wp-content/files/2023/02/Godwin-Emefiele-Central-Bank-Governor.jpg?resize=1080%2C675&ssl=1)

The EFCC alleged that Mr Emefiele knowingly obtained $6.2 million under false pretences. He is accused of misrepresenting a letter purportedly issued by the Secretary to the Government of the Federation on 26 January 2023 (Ref No. SGFF.43/L.01/201) requesting a contingent logistics advance from the CBN, claiming it was in line with a directive from the president—a claim he allegedly knew to be false.

The audit, which reviewed the CBN’s compliance with its revised Investment Policy, stated that “For the year 2021 financial year, the Bank failed to publish the position amounting to US$40,230,803,228.80 of the country’s external reserves to the public.”

It further observed that “there was no waiver or new policy formed during the period to have warranted the non-disclosure.”

The report attributed the failure to “weaknesses in the internal control system at the CBN.”

According to the report, the non-publication violates Article 15(v) of the CBN’s revised Investment Policy, which requires the Bank to establish the content, form, and frequency of communiqués for managing external reserves, specifically “for the purpose of transparency.”

The Auditor General highlighted significant risks stemming from this breach, including a lack of accountability and transparency and potential damage to Nigeria’s economic credibility.

It warned that “foreign investors are not adequately informed on the country’s economic position.”

CBN’s Defence

Responding to the audit query, the CBN management stated that “information on the external reserves position is available to members of the public on the Bank’s website … under the Reserve Management tab.” It added that its Monetary Policy Committee (MPC), which meets bi-monthly, also provides details of the reserves.

Despite this defence, the Auditor General’s evaluation found that the bank’s response failed to address the core issue.

“The response from the Management failed to address the issue raised,” the report said, maintaining that its findings remain valid.

Recommendations

The Auditor General’s report urged the CBN governor to appear before the Public Accounts Committees of the National Assembly to justify the non-publication. It also called for sanctions against the bank under the Financial Regulations Act of 2009, citing “gross misconduct.”

The report recommended that, otherwise, “sanctions relating to gross misconduct prescribed in paragraph 3129 of the Financial Regulations 2009, should apply.”

Money Market Policy

In addition to the non-publication of reserves numbers, the audit also exposed a breach of the CBN’s Money Market Policy.

A dollar time deposit worth $26.05 million exceeded the prescribed maximum maturity period of three months, instead rolling over for five months without the necessary waivers, it said.

The transaction, dated 21 October 2021, matured on 21 March 2022, violating internal policies designed to mitigate liquidity and credit risks.

The Auditor-General again attributed this irregularity to weaknesses in the CBN’s internal control systems.

The central bank defended its actions, stating that its policies permit extensions of up to one year for certain transactions and that the dollar deposit in question adhered to these provisions.

However, the Auditor-General rejected this explanation, citing insufficient evidence to support the claim.

Recommendations

The Auditor-General recommended that the CBN governor should appear before the National Assembly’s Public Accounts Committees to address the non-publication of reserves and justify the maturity extension of the dollar deposit.

The report also called for sanctions against the bank under the Financial Regulations Act of 2009, citing gross misconduct.

“The CBN Governor should be requested to: Furnish the Public Accounts Committees of the National Assembly with the evidence of approval to extend the maximum maturity period of US$26,051,039.29 deposit of the CBN for five months instead of three months, and Otherwise, sanctions relating to gross misconduct prescribed in paragraph 3129 of the Financial Regulations 2009, should apply,” it said.